Applied statistics empowers businesses and economists to make data-driven decisions. The 7th Edition PDF by David Doane and Lori Seward provides essential tools for analyzing economic trends and optimizing business strategies.

Definition and Scope of Applied Statistics

Applied statistics involves the practical application of statistical methods to solve real-world problems in business and economics. It focuses on collecting, analyzing, and interpreting data to inform decision-making. The scope extends to forecasting, risk assessment, and process optimization. Tools like regression analysis and hypothesis testing enable businesses to predict trends and economists to model economic relationships. This field bridges data and actionable insights, making it essential for strategic planning and policy evaluation. The 7th Edition PDF by David Doane and Lori Seward highlights its relevance in modern business and economic contexts, emphasizing its role in driving informed decisions.

Importance of Statistical Analysis in Business Decision-Making

Statistical analysis is crucial for transforming raw data into actionable insights, enabling informed business decisions. It helps identify trends, assess risks, and optimize processes, fostering strategic planning and competitive advantage. By leveraging statistical tools, businesses can predict market dynamics, evaluate customer behavior, and improve operational efficiency. The 7th Edition PDF emphasizes how applied statistics bridges data and decision-making, empowering organizations to navigate uncertainty and achieve sustainable growth. This approach ensures that decisions are grounded in evidence, driving innovation and profitability in both business and economic contexts.

Overview of the PDF Resource on Applied Statistics

The PDF resource on Applied Statistics for Business and Economics is a comprehensive guide bridging statistical theory with practical applications. It covers essential topics like descriptive and inferential statistics, regression analysis, and time series forecasting. Designed for professionals and students, it offers clear explanations and real-world examples to enhance understanding. Focusing on the application of statistical methods in business and economic contexts, it serves as an invaluable tool for data-driven decision-making and problem-solving in these fields, making it essential for effective application today.

Key Concepts and Methods in Applied Statistics

Applied statistics involves essential methods like descriptive and inferential statistics, regression analysis, hypothesis testing, and confidence intervals. These techniques enable data analysis and informed decision-making in business and economics.

Descriptive Statistics: Measures of Central Tendency and Variability

Descriptive statistics summarize and describe datasets, providing insights into central tendency and variability. Measures of central tendency include the mean, median, and mode, which identify data centralization. Variability measures, such as range, variance, and standard deviation, indicate data dispersion. These tools are essential for understanding data distribution and patterns, enabling businesses and economists to assess market trends, operational performance, and customer behavior effectively. By organizing and simplifying complex data, descriptive statistics form the foundation for further statistical analysis and decision-making processes.

Inferential Statistics: Hypothesis Testing and Confidence Intervals

Inferential statistics enables drawing conclusions about populations from sample data, crucial for business and economic decisions. Hypothesis testing involves stating a null and alternative hypothesis, using statistical tests to determine if data rejects the null hypothesis. Confidence intervals estimate population parameters, like means or proportions, providing a range of plausible values. Both methods help assess the significance of results, guiding decisions on strategies, policies, and investments. By quantifying uncertainty, inferential statistics supports robust analysis in forecasting, market research, and risk assessment, aiding data-driven strategies in competitive environments.

Regression Analysis: Predicting Business Outcomes

Regression analysis is a powerful statistical tool for predicting business outcomes by establishing relationships between variables. It helps identify how changes in independent variables, such as price or advertising, impact dependent variables like sales. Simple and multiple regression models are commonly used to forecast trends, optimize strategies, and inform decision-making. By analyzing historical data, businesses can predict future outcomes, enabling proactive planning and resource allocation. This method is widely applied in market research, financial forecasting, and operational planning to drive growth and competitiveness in dynamic business environments.

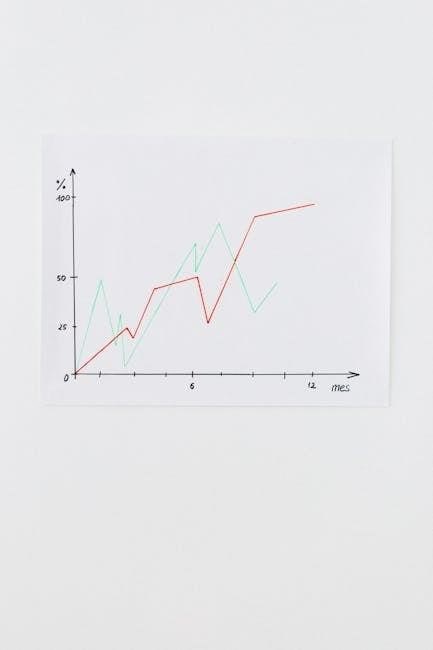

Time Series Analysis: Forecasting Economic Trends

Time series analysis is a statistical method for forecasting economic trends by examining sequential data over time. It identifies patterns, trends, and cycles in historical data to predict future outcomes. Techniques like moving averages, exponential smoothing, and ARIMA models are commonly used. Businesses apply this to forecast sales, inventory, and demand, while economists use it to predict GDP growth, inflation, and unemployment rates; By analyzing temporal data, organizations can make informed decisions, anticipate market shifts, and develop strategic plans to maintain competitiveness in evolving economic landscapes.

Applications of Applied Statistics in Business

Applied statistics drives data-driven decision-making, enhancing market research, operational efficiency, and financial risk assessment. It optimizes business processes, predicts trends, and improves strategic planning across industries.

Market Research and Consumer Behavior Analysis

Applied statistics are integral to market research and understanding consumer behavior. By analyzing data on preferences, purchasing habits, and demographics, businesses can identify trends and tailor strategies. Statistical tools like regression and clustering help segment customers, enabling personalized marketing. Hypothesis testing evaluates the effectiveness of campaigns, while descriptive statistics summarize large datasets. These insights guide product development, pricing, and advertising, ensuring alignment with consumer demands. Ultimately, applied statistics empower businesses to make informed decisions, enhancing competitiveness and customer satisfaction in dynamic markets.

Operational Efficiency: Using Statistics for Process Improvement

Applied statistics play a crucial role in enhancing operational efficiency by identifying bottlenecks and optimizing processes. Tools like regression analysis and hypothesis testing help businesses evaluate performance metrics, such as cycle times and defect rates. Statistical process control ensures consistency and reduces variability, while Six Sigma methodologies leverage data-driven insights to improve quality. By analyzing operational data, companies can streamline workflows, reduce costs, and enhance productivity. These statistical approaches enable data-backed decisions, fostering a culture of continuous improvement and sustainability in business operations.

Financial Analysis: Risk Assessment and Portfolio Management

Applied statistics are vital in financial analysis for assessing risks and managing portfolios effectively. Statistical tools like regression analysis help predict stock prices and evaluate market trends. Portfolio management leverages optimization techniques, such as Modern Portfolio Theory, to balance risk and return. Risk assessment involves analyzing historical data to identify potential losses and volatility. Statistical models also enable stress testing to evaluate portfolio performance under adverse conditions. By applying these methods, businesses and investors make informed decisions to mitigate financial risks and maximize returns in dynamic markets.

Human Resource Management: Analyzing Employee Data

Applied statistics play a crucial role in human resource management by enabling data-driven decisions. HR professionals use statistical methods to analyze employee performance, turnover rates, and compensation structures. Regression analysis helps identify factors influencing employee productivity, while correlation analysis evaluates relationships between variables like training hours and job satisfaction. Statistical insights also inform diversity and inclusion initiatives by measuring representation across teams. By leveraging employee data, organizations can optimize recruitment strategies, improve retention, and enhance overall workforce performance, ultimately aligning HR practices with business objectives.

Applications of Applied Statistics in Economics

Applied statistics in economics analyzes data to understand trends, predict outcomes, and inform policy decisions, aiding in resource allocation and economic growth strategies effectively.

Economic Indicators: GDP, Inflation, and Unemployment

Economic indicators like GDP, inflation, and unemployment are crucial for assessing a nation’s economic health; Applied statistics helps analyze these metrics to understand economic trends and patterns. GDP measures economic output, while inflation tracks price changes, and unemployment reflects labor market conditions. Statistical methods enable forecasting and policy-making. For instance, regression models predict GDP growth, and time series analysis identifies inflation trends. These tools aid policymakers in designing strategies to stabilize economies and promote growth, ensuring data-driven decisions for sustainable development.

Econometric Modeling: Understanding Economic Relationships

Econometric modeling is a statistical approach to analyzing economic relationships between variables. It involves developing mathematical models to estimate the impact of factors like pricing, demand, and policy changes. Applied statistics provides tools like regression analysis and hypothesis testing to build these models. Econometric models help predict outcomes, evaluate policies, and understand cause-and-effect relationships. They are widely used in forecasting economic trends, assessing market dynamics, and informing decision-making. By leveraging data, econometric models enable businesses and economists to make precise, data-driven predictions and strategies.

Policy Evaluation: Assessing the Impact of Economic Policies

Policy evaluation uses applied statistics to measure the effectiveness of economic policies. By analyzing data, statisticians determine whether policies achieve their intended outcomes. Techniques like regression analysis and hypothesis testing assess relationships between policy implementation and economic indicators. Data such as GDP growth, employment rates, and income levels are evaluated. Statistical methods help identify causal effects, ensuring decisions are evidence-based. This process enables policymakers to refine strategies and allocate resources efficiently, promoting sustainable economic development and improving public welfare. Applied statistics provide a robust framework for objective policy assessment.

International Trade Analysis: Using Statistical Methods

Applied statistics play a crucial role in analyzing international trade patterns. Statistical methods such as time series analysis and regression models help forecast trade volumes and identify trends. Trade balances, export-import ratios, and tariff impacts are evaluated using hypothesis testing. Geographical information systems (GIS) map trade flows, while cluster analysis identifies emerging markets. These tools enable businesses and policymakers to make data-driven decisions, optimizing trade agreements and mitigating risks. Statistical insights also inform policy development, fostering global economic collaboration and competitiveness. This ensures sustainable growth in international trade environments.

Software and Tools for Applied Statistical Analysis

Popular tools include Excel for basic analysis, R and Python for advanced computations, and SPSS/SAS for professional statistical modeling. These tools enhance data processing efficiency.

Microsoft Excel: Basic Statistical Functions

Microsoft Excel is a fundamental tool for performing basic statistical operations in business and economics. It offers built-in functions like AVERAGE for calculating means, STDEV for standard deviation, and VAR for variance. These functions are essential for analyzing datasets, such as calculating average income in a region or the variability of sales data. Excel also supports regression analysis through the LINEST function, helping predict business outcomes. Additionally, its pivot tables and charting capabilities make data visualization straightforward. While Excel is not as advanced as specialized software, it remains a widely accessible and user-friendly option for basic statistical tasks in applied statistics.

R Programming: Advanced Statistical Computing

R is a powerful, open-source programming language tailored for advanced statistical analysis. It offers extensive libraries like dplyr and tidyr for data manipulation, and ggplot2 for data visualization. R excels in complex tasks such as hypothesis testing, regression analysis, and time series forecasting. Its flexibility allows customization of models and workflows, making it a favorite in academic research and business analytics. Additionally, R integrates seamlessly with machine learning frameworks and supports big data processing. For professionals in business and economics, R provides robust tools to uncover insights and drive data-driven decision-making, making it indispensable in modern statistical computing.

Python Libraries: NumPy, pandas, and statsmodels

Python’s powerful libraries—NumPy, pandas, and statsmodels—are essential for advanced statistical computing in business and economics. NumPy provides efficient numerical operations, while pandas excels in data manipulation and analysis. Statsmodels offers comprehensive tools for statistical modeling, including regression and hypothesis testing. Together, these libraries enable data visualization, predictive analytics, and machine learning. Their versatility and extensive community support make them indispensable for handling complex datasets and deriving actionable insights, particularly in applied statistics for decision-making and economic analysis.

SPSS and SAS: Professional Statistical Software

SPSS and SAS are industry-leading tools for advanced statistical analysis, widely used in business and economics. SPSS excels in data management, predictive analytics, and visualization, while SAS is renowned for its robust data manipulation and enterprise-level capabilities. Both platforms support complex statistical procedures, including regression, forecasting, and multivariate analysis. They are particularly valued for their ability to handle large datasets and provide actionable insights. These professional software solutions are indispensable for organizations requiring precise and scalable statistical computations to drive informed decision-making in competitive environments.

Case Studies and Real-World Examples

Explore practical applications of applied statistics in business and economics through real-world examples, such as market trend analysis, economic policy impact assessment, and customer segmentation strategies.

Using Regression Analysis in Business Forecasting

Regression analysis is a powerful tool for predicting future business outcomes based on historical data. By identifying relationships between variables, companies can forecast sales, revenue, and market trends. For example, a retail firm might use regression to predict holiday sales by analyzing historical data on pricing, advertising, and seasonality. This enables informed decision-making, such as inventory management and resource allocation. Real-world applications demonstrate how regression models provide actionable insights, helping businesses stay competitive and responsive to market changes. Such analyses are essential for strategic planning and achieving sustainable growth in dynamic markets.

Statistical Quality Control in Manufacturing

Statistical quality control is a method used in manufacturing to monitor and maintain product consistency. By analyzing data, manufacturers can identify defects and variability in production processes. Tools like control charts and process capability analysis help detect deviations from standards. For instance, a car manufacturer might use statistical methods to ensure engine parts meet precise specifications. This reduces waste, improves reliability, and enhances customer satisfaction. Implementing these techniques aligns with initiatives like Six Sigma and Total Quality Management, fostering a culture of continuous improvement and operational excellence in manufacturing environments.

Economic Impact Analysis of Government Policies

Economic impact analysis evaluates how government policies affect the economy, using statistical methods to measure outcomes. Techniques like econometric modeling and regression analysis assess policy effects on GDP, employment, and inflation. For example, tax reforms or trade policies can be analyzed to predict their impact on economic growth. Historical data and forecasting models help policymakers anticipate consequences. This approach ensures data-driven decisions, minimizing adverse effects and maximizing benefits. Applied statistics enable precise evaluations, guiding governments to implement policies that foster sustainable economic development and improve public welfare effectively.

Customer Segmentation Using Cluster Analysis

Cluster analysis is a statistical technique used to segment customers into groups with similar characteristics, enabling targeted marketing strategies. Businesses apply methods like K-means clustering to analyze demographic, behavioral, and transactional data. This segmentation helps identify high-value customers, tailor product offerings, and improve customer retention. By understanding preferences and purchasing patterns, companies can enhance personalized experiences and loyalty. Applied statistics in this context drive data-driven decisions, ensuring efficient resource allocation and maximizing market impact. Cluster analysis is essential for modern businesses aiming to deliver tailored solutions and maintain competitive advantage in dynamic markets.

Best Practices for Implementing Statistical Methods

Adopt robust data collection, ensure data quality, and preprocess meticulously. Use appropriate models, validate results, and avoid biases. Communicate insights clearly to stakeholders for informed decisions.

Data Collection and Preprocessing Techniques

Data collection involves gathering information from primary sources like surveys and experiments or secondary sources such as existing databases. It’s crucial to select methods that align with research objectives. Preprocessing includes cleaning data by addressing missing values, duplicates, and outliers. Data transformation, like normalization, is often necessary for analysis. Proper documentation ensures transparency and reproducibility. These techniques are essential for accurate analysis in business and economics, ensuring reliable data for informed decision-making and modeling accuracy. Attention to detail in these steps enhances overall data quality.

Interpreting Statistical Results for Business Decisions

Interpreting statistical results involves translating complex data into actionable insights. Business leaders must focus on key metrics, such as confidence intervals and p-values, to assess significance. Results should be aligned with business objectives, ensuring decisions are data-driven. Avoid overcomplicating interpretations and communicate findings clearly. Consider both statistical and practical significance to avoid misjudging results. Effective interpretation enables informed decisions, such as optimizing operations or identifying market trends. It’s crucial to present findings in a way that supports strategic planning and aligns with organizational goals, making statistics a valuable tool for driving success.

Avoiding Common Statistical Mistakes

Avoiding common statistical mistakes ensures reliable and credible analysis. Overreliance on p-values without context is a frequent error. Always consider practical significance alongside statistical significance. Misinterpreting correlation as causation is another pitfall. Avoid sampling bias by ensuring diverse and representative data. Be cautious of data dredging and confirmatory bias. Validate assumptions underlying statistical tests, such as normality or homogeneity of variance. Clearly communicate limitations to prevent overgeneralization. Regularly cross-verify results and use robust methods to minimize errors. Awareness of these mistakes enhances the accuracy and trustworthiness of statistical conclusions in business and economics.

Communicating Statistical Insights to Stakeholders

Effectively communicating statistical insights to stakeholders is crucial for informed decision-making. Use clear, simple language and avoid technical jargon to ensure understanding. Visual aids like charts and graphs can simplify complex data. Tailor your message to the audience, focusing on actionable insights. Highlight key findings and their practical implications. Encourage collaboration by engaging stakeholders in discussions. Provide context to help interpret results. Use bullet points for clarity and prioritize brevity. Regularly seek feedback to refine your approach. This ensures that statistical insights are accessible, meaningful, and impactful for business and economic applications.

Applied statistics plays a pivotal role in business and economics, driving data-driven decisions. Future trends include leveraging big data, AI, and machine learning for advanced analytics.

The Evolving Role of Applied Statistics in Business and Economics

The role of applied statistics in business and economics is rapidly evolving, driven by the increasing availability of big data and advanced computational tools. Businesses now rely on sophisticated statistical methods to analyze market trends, predict consumer behavior, and optimize operational efficiency. Similarly, economists use applied statistics to model economic systems, assess policy impacts, and forecast future trends. The integration of machine learning and artificial intelligence into statistical practices has further enhanced the ability to process complex data sets and make accurate predictions. As a result, applied statistics has become an indispensable tool for data-driven decision-making in both fields.

Emerging Trends: Big Data and Machine Learning

Big data and machine learning are revolutionizing applied statistics in business and economics. The ability to process vast datasets has enabled organizations to uncover deeper insights and make smarter decisions. Machine learning algorithms, such as neural networks and decision trees, are being integrated into statistical models to improve predictive accuracy. These technologies allow businesses to analyze customer behavior, optimize supply chains, and forecast market trends with greater precision. As big data continues to grow, the fusion of applied statistics with machine learning will drive innovation and create new opportunities for data-driven decision-making across industries.

Continuous Learning and Professional Development

Continuous learning is essential for professionals in applied statistics to stay competitive in a rapidly evolving field. With advancements in technology and methodologies, ongoing education ensures proficiency in new tools and techniques. Professionals should pursue certifications, attend workshops, and engage in online courses to enhance their skills. Staying updated on industry trends and networking with peers through conferences or forums can provide valuable insights. By dedicating time to professional development, individuals can apply statistical knowledge more effectively in solving complex business and economic challenges, driving innovation and career growth.